Black Money Flows In Indian ECONOMY as FDI as Swiss relax rules for info exchange on foreign black money!

Troubled Galaxy Destroyed Dreams, Chapter 584

Palash Biswas

http://indianholocaustmyfatherslifeandtime.blogspot.com/

http://basantipurtimes.blogspot.com/

Black Money Flows In Indian ECONOMY as FDI as Swiss relax rules for info exchange on foreign black money!In a move that could help India in its black money trail, Switzerland today relaxed norms for sharing information on secret bank accounts of overseas tax offenders by allowing varied modes of identification.The government has decided to increase vigil on all foreign direct investment (FDI) flows from Mauritius amid growing concern that black money stashed abroad by Indians is being routed back into the country through the island nation, the Economic Times said Tuesday.

India's foreign direct investment (FDI) through Mauritius, considered a tax haven, has crossed $50 billion accounting for 42 per cent of the total FDI inflows, according to the latest official data.

India has a Double Taxation Avoidance Treaty (DTAA) with Mauritius, under which the corporates registered there can choose to pay taxes in the island nation.

Experts said companies prefer to route their investment through the famous Mauritius route because of as low as three per cent effective rate of corporate tax on the foreign companies incorporated there.

Besides, an investor routing his investments through Mauritius into India does not pay capital gains tax either in India or Mauritius.

"Mauritius is an offshore financial centre. There is no provision of capital gains tax," said PWC Executive Director Akash Gupta.

According to FICCI Director General Rajiv Kumar "clear reason for bulk of the FDI coming from Mauritius is the DTAA which allows higher returns to investors... It is a good channel to use, as it gives significant savings."

It is estimated that the government may be losing Rs 2,000 crore per annum because of the "treaty shopping".

Of the total USD 121.26 billion FDI that has come between April 2000 and August 2010, Mauritius accounted for USD 50.16 billion, according to the latest official data.

Though India has a DTAA with about 75 countries like the US, UK, Japan, France, and Germany, it is Mauritius which is the most preferred route for FDI inflows because of low or zero corporate tax, an official said.

Even though India offers several exemptions and reliefs to companies on the corporation tax of 30 per cent, the effective rate in the country for the corporate is no less than 20 per cent.

After Mauritius, India received highest FDI of $11.27 billion from Singapore, $8.91 from the followed by UK ($6.15 billion) and the Netherlands ($4.96 billion), Japan ($4.53 billion), Cyprus ($4.2 billion), and Germany ($2.86 billion) since 2000.

| BLACK MARKET AND THE INDIAN ECONOMY Uploaded by barkhaamonkar (634) on Sep 20, 2005 | ||

|

http://www.echeat.com/essay.php?t=28005

Black money abroad? It's returning via FDI, P-Notes!

Last updated on: February 11, 2011 17:54 IST

Share

this

Ask

Users

Write a

Comment

Next

N Chandra Mohan

The recent expos of Swiss bank account holders has rekindled a controversy regarding the amount of illegal money stashed abroad by Indians.

Political leaders have been demanding these funds be returned and even distributed to the poor.

Amazing sums like $1.4 trillion have been bandied about, even though it is well-recognised that the exact numbers are difficult to come by.

Click NEXT to read on . . .

http://www.rediff.com/business/slide-show/slide-show-1-black-money-abroad-its-returning-via-fdi-p-notes/20110211.htmBlack money to be taxable under DTC: Govt

Last updated on: February 9, 2011 18:16 IST

Share

this

Ask

Users

Write a

Comment

Next

Black money parked in tax havens abroad will be taxable income under the Direct Taxes Code Bill, the Centre told the Supreme Court on Wednesday, spelling out a host of measures to retrieve it.

The government also informed the apex court that it has completed negotiations for Tax Informations Exchange Agreement with 10 countries where the money is believed to have been stashed.

Click NEXT to read further. . .

2010 FDI flows may beat forecast 12 bln rupees

* Real estate, hospitality sectors on receiving end of FDI

PORT LOUIS, Jan 18 (Reuters) - Mauritius sees foreign direct investment (FDI) to the Indian Ocean island growing by 8 percent in 2011, boosted by flows into the hospitality and property sectors, an official said on Tuesday.

Prakash Maunthrooa, managing director of the Board of Investment, said FDI to Mauritius had picked up steadily since the financial downturn curbed flows in 2009. The luxury real estate sector in particular took a hammering.

Mauritius pitches itself as a bridge between Africa and Asia.

"On a conservative basis we are targeting 13 billion rupees ($428 million) of foreign direct investment this year," Maunthrooa told Reuters.

Final numbers are not in for last year, but Maunthrooa said it was possible foreign investment flows in 2010 exceeded the forecast 12 billion rupees.

Bank of Mauritius data showed that FDI worth 8.9 billion rupees flowed into the island of 1.3 million people during the first seven months of 2010. A quarter of this was ploughed into real estate and the European Union was the leading source of investment accounting for 4.2 billion rupees.

Famed for its white sand beaches and luxury spas, Mauritius is diversifying its economy away from the traditional sugar, textiles and tourism sectors into offshore banking, business outsourcing, luxury real estate and medical tourism. (Reporting by Jean Paul Arouff; Editing by Richard Lough/Ruth Pitchford)

http://af.reuters.com/article/mauritiusNews/idAFLDE70H16Y20110118

-

I-T to check FDI from Mauritius for black money

Economic Times - 16 hours ago

NEW DELHI: The government has decided to increase vigil on all foreign direct investment (FDI) flows from Mauritius amid growing concern that black money ...

-

Not routing black money into India: Mauritius

Times of India - 4 Feb 2011

I believe that about 44 per cent of Foreign Direct Investment (FDI) into India ... to Mauritius on any particular aspect of checking the black money flow, ...

-

Not routing black money into India: Mauritius

Oneindia - 3 Feb 2011

I believe that about 44 percent of Foreign Direct Investment (FDI) into India is routedthrough Mauritius. Mechanisms are in place (to check the issueof ...

Not routing black money into India: Mauritius - Daily News & Analysis

all 8 news articles »

-

FDI into southern Africa down

The Southern Times - 28 Jan 2011

Meanwhile, UNCTAD noted that FDI flows to developing economies in general and Africa in particular rose some 10 percent to US$525 billion during the period, ...

-

Black money hoarders:govt starts legal action

Gulf Times - 5 Feb 2011

I believe that about 44% of Foreign Direct Investment (FDI) into India is routed through Mauritius. Mechanisms are in place (to check the issue of black ...

* -

blackmoney double taxation treaty with saarc to come into effect

SamayLive - 4 Feb 2011

I believe that about 44 percent of Foreign Direct Investment (FDI) into India is routedthrough Mauritius. Mechanisms are in place (to check the issueof ...

* -

"Scrutiny of investment from Mauritius is being enhanced," a finance ministry official told ET. Mauritius accounts for more than 40% of all foreign direct investment flows into the country.

The income-tax department has deputed an official in Mauritius to coordinate with the government and the revenue authorities there to ascertain details of funds that have been invested in India, the official said.

The department is keen to scrutinise all FDI proposals from the island nation that go to the Foreign Investment Promotion Board for clearance. Sectors such as real estate will particularly be under the lens.

At present, only name and addresses are accepted as valid identity modes.

But the European nation would still consider as impermissible any ''fishing expeditions'' or allowing the foreign countries to trawl through Swiss bank accounts in hope of finding something of their interest.

The changes were made by the Swiss government''s finance ministry today through a revision of ''Requirements for Administrative Assistance in Tax Matters,'' an official said from Bern, Switzerland.

The Indian government is facing intense pressure from Opposition, as also courts, to act tough against those who have amassed illicit wealth in foreign countries that have strict secrecy rules.'

The Swiss Parliament is debating a treaty between India and Switzerland to pave the way for authorities here to seek details of illicit wealth stashed away by Indians in Swiss banks.

As per the existing practice, the foreign country having an information exchange-facilitating treaty with Switzerland can get help from the Swiss government after providing name and address of the suspected tax offender, as also those of the concerned bank.

As per the revision, "other means of identification should also be admissible in the future".

While Switzerland has not clarified what all ''other means'' of identification modes would be admissible for seeking information on suspected tax offenders, the Swiss Federal Department of Finance said that "identification via a bank account is also a possibility."

"... although care should be taken in these cases to ensure that a fishing expedition is not involved," the ministry said.

"Fishing expeditions continue to be impermissible," it added.

To bring this revision into effect, the administrative assistance provisions in double taxation agreements (DTAs) between Swiss and other governments would need to be revised.

In the DTA negotiations up to now, including the one with India, the name and address of not only the person but also the bank is needed in administrative assistance requests.

Besides, the ongoing parliamentary debate in Switzerland on 10 treaties, including the one with India, it has been said that "administrative assistance be permitted only if the name and address of the person and the information holder concerned are indicated in the request." .

In a move that could help India in its black money trail, Switzerland today relaxed norms for sharing information on secret bank accounts of overseas tax offenders by allowing varied modes of identification.

At present, only name and addresses are accepted as valid identity modes.

Ramkishen S Rajan and Sasidaran Gopalan question the usefulness of the government's bilateral FDI inflows data

What to make of Mauritius

Sasidaran Gopalan, Ramkishen S RajanPosted: Saturday, Jan 02, 2010 at 2101 hrs IST

India has become increasingly important both as a source and as a host of foreign direct investment (FDI) over the last decade. But trying to make sense of the numbers regarding FDI inflows and outflows can be quite challenging.

The data on bilateral FDI outflows is sketchy; finance ministry reports the value of aggregate FDI outflows from India and the value of approvals of FDI outflows at a bilateral level, but a consistent time series of the actual value of outflows with a country-wise breakdown isn't available in public domain. While data on actual FDI inflows is reported by the Department of Industrial Policy and Promotion at a disaggregated country level, there are serious concerns about the usefulness of bilateral FDI inflows data available in the public domain.

For example, the data on FDI inflows into India almost always shows Mauritius to be the largest source of foreign investment flows into the country. But Mauritius is widely regarded as an offshore financial centre (OFC) used by foreign investors as an intermediary to reach India, predominantly to capitalise on tax rebates. Conversely, as Indian companies become globalised, many have chosen to either use their overseas locally-incorporated subsidiaries to invest overseas or have established holding companies and/or special purpose vehicles in OFCs or other regional financial centres like Singapore or Netherlands to raise funds and invest in third countries.

Apart from such transhipping, some of the inflows from Mauritius in particular, but also from other OFCs, could also be round-tripping back to India to escape capital gains tax or for other reasons, not unlike the investments dynamics between China and Hong Kong.

Bilateral FDI data—which only captures the actual flow of funds rather than ultimate ownership—may present a rather distorted picture of the extent of linkages between India and the rest of the world. Usefulness of such data for research and policy purposes needs to be examined as it gives a misleading picture. There are serious lacunae in the way direct cross-border investment flows are reported, hence the need for alternative datasets.

In order to understand de facto linkages between India and the world, one needs to examine the data on actual ownership of the foreign investment flows coming into the country. While data on individual firms that have invested in India may be available via firm-level surveys, for a more complete picture of FDI inflows into the entire economy one needs to examine an aggregation of all such firms investing in India from different parts of the world. This would be a prohibitively costly exercise. A more feasible alternative would be to examine the data on mergers and acquisitions (M&As) made by global firms in India and Indian firms globally. Such data, tracking actual ownership of purchases and sales, is maintained by many commercial entities, unlike the data on FDI flows that is compiled by national sources.

Two basic conclusions arise. One, many acquisitions by the US and the UK have been channelled via Mauritius. Two, Indian companies have largely been using Singapore, Netherlands and OFCs as intermediaries to purchase assets overseas, primarily in the developed world and resource-rich countries. While OFCs are used as tax havens, both Singapore and Netherlands are attractive hosts for holding companies from India and elsewhere for (a) their low and simple tax rates, (b) the large number of double tax treaties between the two countries and the world, (c) use of English, (d) human capital and (e) excellent logistics plus air and sea connections. All this explains their attraction to Indian businesses eager to internationalise their operations.

Figures 2 and 3 capture data on FDI inflows (reported by the Indian government) and M&A purchases (reported by commercial entities) that have taken place in India (by source of origin) in 2000-07. A comparison reveals the above discussed inconsistencies.

It is interesting to see that most of the OFCs like Mauritius (mainly) but also Cyprus, Cayman Island and Bermuda, which comprise nearly 50% share of the total FDI inflows (as reported by government sources) do not even figure in the data on inbound M&As to India.

Focusing on the FDI data, only 18% of inflows to India have been by the US and the UK combined, while about 15% are by the non-UK European countries (mainly Netherlands, France and Germany) and about 10% by East Asia (mainly Singapore and Japan). In contrast, the M&A data on foreign acquisitions in India tell quite a different story. The US is the single largest acquirer of Indian companies (35%), followed by the UK (16%) and the rest of Europe, including Netherlands (27%) and East Asia (18%) (distributed between Japan, Singapore, Malaysia and Hong Kong). So almost all of the inbound acquisitions to India have been by the US, Europe and Asia. This appears to offer a far more informative geographical breakdown of sources of direct investment equity flows to India compared to the FDI data.

As noted, similar bilateral data on India's actual FDI outflows are not publicly available on a systematic time series basis. While approvals may not provide a fully realistic picture as not all approvals are realised, available data, at least for aggregate actual outflows, suggest that there is a reasonable degree of correlation between approved and the actual outward FDI flows from India.

Accordingly, the outward FDI approvals data ought to offer some useful insight when compared to data on India's M&A purchases overseas. It is well known that Indian businesses have been very active in overseas investments in the last few years, particularly since 2006. Anecdotal evidence and examples point to the fact that many of these investments have been in developed countries like the US, the UK and rest of Europe. Notable instances would be Tata Steel's purchase of Corus and Tata Motors' purchase of Jaguar and Land Rover in the UK, and Hindalco's acquisition of the Canadian aluminium giant Novelis.

Developed countries like the UK and the US have surprisingly small shares of India's approved outward FDI (6% each) for recent periods for which detailed data are available (2002-08) compared to Singapore (22%), the Netherlands (15%) and Mauritius and other OFCs in total (25%). So, over 50% of India's approved FDI is destined to the financial centres (regional and offshore).

Examination of M&A purchases for more or less the same period (2000-07), however, reveals quite a different picture. Canada emerges as the top host country for India's outbound acquisitions with a 34% share, followed by the US with a 24% share. While Indian companies have undertaken a number of varied purchases in the US, acquisitions in Canada have been concentrated in resources, including Novelis mentioned above. Apart from these, around 16% of India's acquisitions have been aimed at resources rich countries (Russia, Egypt, Australia and South Africa) and the rest to the UK and Europe (17%). The Tata Motors' acquisitions of Jaguar and Land Rover Brands from the UK do not show up in our data as they were done in early 2008. It is likely that an extension of the data to 2008 would see a jump up in the UK as a source of Indian outbound M&As, as would Europe in general.

One clearly has to be cautious in comparing the two sets of data (FDI versus M&A), as the M&A data excludes greenfield investments. While M&As are growing as the preferred mode of foreign entry, M&A data are not from national sources, being sourced from commercial entities, and there are questions about consistency in terms of company coverage, definitions and such. In addition, tracking transactions based on ownership is always tricky, particularly given the increasing complexity of global businesses. All this being said, the important point is that India's FDI data at a bilateral level may offer quite a misleading indication of the extent of real linkages and should be interpreted with extreme caution, a point that researchers and analysts have failed to adequately appreciate.

Ramkishen S Rajan is an associate professor at George Mason University, Virginia, US. His coauthor Sasidaran Gopalan is a research associate at the Institute of South Asian Studies (ISAS), National University of Singapore

http://www.financialexpress.com/news/what-to-make-of-mauritius/562219/0

But the European nation would still consider as impermissible any ''fishing expeditions'' or allowing the foreign countries to trawl through Swiss bank accounts in hope of finding something of their interest.

The changes were made by the Swiss government''s finance ministry today through a revision of ''Requirements for Administrative Assistance in Tax Matters,'' an official said from Bern, Switzerland.

The Indian government is facing intense pressure from Opposition, as also courts, to act tough against those who have amassed illicit wealth in foreign countries that have strict secrecy rules.

The Swiss Parliament is debating a treaty between India and Switzerland to pave the way for authorities here to seek details of illicit wealth stashed away by Indians in Swiss banks.

As per the existing practice, the foreign country having an information exchange-facilitating treaty with Switzerland can get help from the Swiss government after providing name and address of the suspected tax offender, as also those of the concerned bank.

As per the revision, "other means of identification should also be admissible in the future".

While Switzerland has not clarified what all ''other means'' of identification modes would be admissible for seeking information on suspected tax offenders, the Swiss Federal Department of Finance said that "identification via a bank account is also a possibility."

"... although care should be taken in these cases to ensure that a fishing expedition is not involved," the ministry said.

"Fishing expeditions continue to be impermissible," it added.

To bring this revision into effect, the administrative assistance provisions in double taxation agreements (DTAs) between Swiss and other governments would need to be revised.

In the DTA negotiations up to now, including the one with India, the name and address of not only the person but also the bank is needed in administrative assistance requests.

Besides, the ongoing parliamentary debate in Switzerland on 10 treaties, including the one with India, it has been said that "administrative assistance be permitted only if the name and address of the person and the information holder concerned are indicated in the request." .

-

Pratiyogita Darpan - Jul 2007 - Google Books Result

-

- 176 pages

Mauritius was the leading investor amounting for more than half of the FDI flows

-

. The high FDI flow from Mauritius is partly due to the fact that many ...

-

books.google.co.in/books?id=7egDAAAAMBAJ

-

I-T to check FDI from Mauritius for black money - NEWSPOLITAN

-

14 Feb 2011 ... NEW DELHI: The government has decided to increase vigil on all foreign direct

-

investment (FDI) flows from Mauritius amid growing concern ...

-

newspolitan.com/india/politics/2011/0... - Similar

-

Free Research Paper on Fdi Flows To China Table Recent 181 - 210

-

Fdi And Fii From Treasurer Perspective: 187% of the 24613 crore recorded during

-

200506, with the largest share of FDI flows from Mauritius, followed by the ...

-

www.cyberessays.com/lists/fdi-flows-t... - Cached - Similar

-

Mauritius and Seychelles as channels for Foreign Direct Investment ...

-

FDI flows to Africa. In terms of sources of Foreign Direct. Investment (FDI)

-

flows to Africa, the US, ... part of Africa, Mauritius and Seychelles are not

-

...

-

www.applebyglobal.com/uploaded/Public... - Cached - Similar

-

Concerns on Foreign Funds Flow through Mauritius - "Fii Trades ...

-

28 May 2010 ... This potential hot money from Mauritius accounts for a little more than half the

-

FDI inflow into India each year which can not only ...

-

fiitrades.blogspot.com/2010/05/concer... - Cached - Similar

-

Foreign Direct Investment

-

... per cent of the total FDI equity inflow into India, with FDI worth US$ 2163

-

... The FDI equity inflows in Mauritius is followed by Singapore at US$ 1282 ...

-

www.ibef.org/economy/fdi.aspx - Cached - Similar

-

Seychelles, Offshore, Mauritius and Seychelles as Channels for ...

-

11 Jan 2011 ... 11 Jan 2011 - Seychelles - Offshore - Mauritius and Seychelles as ... In terms

-

of sources of foreign direct investment ("FDI") flows to ...

-

www.mondaq.com/article.asp%3Farticlei... - Cached - Similar

-

FDI and Export Performance of the Mauritian Manufacturing Sector

-

By 1977, 86 firms were operating in the zone, employing 17474 workers, about 80%

-

of which were female. Figure 1: FDI Flows in the Mauritian EPZ,. 1971-2000 ...

-

r0.unctad.org/p166/reduit2004/module6... - Cached - Similar

-

TALKING POINTS: INDIA-AFRICA RELATIONS & BUSINESS OPPORTUNITIES IN ...

-

sources of FDI flow. More importantly perhaps I will elaborate on the lessons

-

... Mauritius and Foreign Investments in light of the World Investment Report

-

...

-

www.investmauritius.com/newsletter_ju... - Cached - Similar

-

Mauritian FDI route still most favoured

-

22 Apr 2005 ... New Delhi, April 21: Mauritius continues to top the list of FDI flows into India

-

accounting for 31.23% of the total inflows for ...

-

www.financialexpress.com/news/mauriti... - Cached - Similar

-

Times of India Publications

-

15 Feb 2011 ... The government has decided to increase vigil on all foreign direct investment (

-

FDI) flows from Mauritius amid growing concern that black ...

-

lite.epaper.timesofindia.com/mobile.a... - Similar

-

World Investment Report 2007: Transition Corporations, Extractive ... - Google Books Result

-

United Nations Conference on Trade and Development - 2007 - 294 pages

-

Africa: distribution of FDI flows among economies, by range, 2006 Mali, ...

-

Algeria, Tunisia, Cape Verde, Djibouti, Guinea, Mauritius, Somalia, Gambia, ...

-

books.google.co.in/books?isbn=9211127181

-

Foreign Direct investment in India

-

Lot of investment is expected to flow into petroleum, manufacturing and ... In

-

FDI equity investments Mauritius tops the list of first ten investing ...

-

www.indiaonestop.com/FDI/FDI.htm - Cached - Similar

-

COMESA SUCCESS STORIES IN INVESTMENTS - News & Events - Anahita ...

-

16 Apr 2009 ... Nestled on the east coast of Mauritius, the estate offers a wide variety of ...

-

In the year 2007, the foreign direct investment flows into ...

-

www.anahitamauritius.com/propertysale... - Cached - Similar

-

South-South Foreign Direct Investment Flows - Global Studies Review

-

10 Oct 2010 ... This phenomenon of so called South-South FDI flows, .... to India via Mauritius

-

which has consistently been the top source of FDI to India. ...

-

www.globality-gmu.net/archives/2248 - Cached - Similar

-

Foreign Direct Investment in Africa: Performance, Challenges and ...

-

Mauritius, and Botswana, are also likely to experience an increase in FDI flows

-

because of the relative improvement in their economic policies in the last ...

-

www.uneca.org/atpc/Work%2520in%2520pr... - Cached - Similar

-

How did a tiny country like Mauritius become the biggest FDI ...

-

5 Apr 2009 ... The effects of increased flow of foreign direct investment from Mauritius to

-

India has been that it has led to the generation of a lot of ...

-

in.answers.yahoo.com/question/index%3... - Cached - Similar

-

Mauritius main funnel for FDI flows - Daily News & Analysis - Allo ...

-

4 Jun 2007 ... Expatriates discussion forum about living in Mauritius by Allo' Expat for

-

expatriate, traveler or Mauritian to chat with the Mauritius ...

-

www.alloexpat.com/mauritius_expat_for... - Cached - Similar

-

FDI flow: Maharashtra, NCR take lion's share

-

22 Nov 2010 ... The state attracted the highest FDI inflow at Rs 11154 crore, which is 35 per

-

... The highest FDI of $2.92 came from Mauritius, followed by ...

-

www.pbd.in/index.php%3Foption%3Dcom_c... - Cached - Similar

-

Foreign Direct Investment Flows within Developing Asia - Roubini ...

-

21 May 2008 ... Four, FDI flows between East Asia and South Asia remains low and stagnant ... In

-

addition, Mauritius has low corporate tax and has a liberal ...

-

www.roubini.com/asia-monitor/252649/f... - Cached - Similar

FDI from Mauritius

FDI from Mauritius to India is the highest in comparison with all the other countries that invest in India. FDI from Mauritius to India is the highest due to the special treatment of tax that is given in India to the investments that come through Mauritius.

Foreign direct investment in India:

The Indian government realized the fact that foreign direct investment plays a very crucial role in boosting the country's economy by developing the infrastructure, generating new jobs, transfer of technology, and increasing productivity.Thus the government of India liberalized its economic policies in order to use foreign direct investment as a developmental tool. India offers several positive incentives to the foreign investors such as an abundant supply of educated workforce, low wages, and very strong economic growth in the country which has increased the middle class's power of buying.

Flow of foreign direct investment from Mauritius to India:

The first rank goes to Mauritius in terms of highest inflow of foreign direct investment to India in comparison with all the other countries that make investments in India. This is due to the fact that special tax treatment is given to all those investments that come through Mauritius to India. The total amount of FDI from Mauritius to India came to Rs. 27,891.15 crore between 1991 to 2002. The total percentage of FDI from Mauritius to India stood at 38.7% out of the total foreign direct investment in the country from 1991 to 2002.

Industries attracting FDI from Mauritius to India are:

Electrical equipment Gypsum and cement products Telecommunications Services sector that includes both non- financial and financial Fuels

Effects of FDI from Mauritius to India:

The effects of increased flow of foreign direct investment from Mauritius to India has been that it has led to the generation of a lot of new employment opportunities, development of the sectors that have received investments, and also growth of the country's economy.http://business.mapsofindia.com/fdi-india/investing-country/mauritius.html

Indian Budget for 2011-12 not likely to be pro-market

February 15, 2011 05:00 PM

Munira Dongre

In the Union Budget for FY12, there are likely to be cuts in excise duty exemptions and more services may be made liable to be taxed. The government may also reduce the tax burden on the middle class, at least to a small extent

There is an agreement that while announcing this year's Budget, the three biggest challenges that the government faces are-the large deficit, high crude prices, and high inflation.

Most market watchers believe that to get government finances in order (the government is facing a fiscal deficit of 5% in FY12) the government will have to widen and deepen the tax net. There are likely to be cuts in excise duty exemptions and more services will be made liable to be taxed.

However, in a smart move, the government may reduce the tax burden on the middle class-at least to a small extent. Diesel price decontrol is unlikely in the Budget session.

The government is very aware of the perception that reforms have slowed. However, it may not do too much about this since state elections are round the corner in Tamil Nadu, Kerala, and West Bengal.

On the positive side in FY11, revenues are expected to be higher due to higher tax collections. However, expenses are expected to shoot up due to higher subsidies too-food, fertiliser, and oil. The total subsidy bill could touch about Rs2 trillion in FY11.

Certain fiscal expansions in recent years are irreversible and can only keep going higher-the main being the Pay Commission revisions and the Mahatma Gandhi National Rural Employment Guarantee Act (scheme), which is now linked to inflation.

It is unlikely that any government which is in power will find it prudent to disband the Mahatma Gandhi NREGA scheme and it is here to stay. It is India's answer to the unemployment dole or social security in Western countries. The NREGA allocation is expected to increase.

The government's borrowing in FY12 is likely to be Rs3.75 trillion-Rs4.0 trillion. This year, divestment is not likely to cushion the impact of a burgeoning expenditure account due to higher subsidies.

The government may have to go through a massive cost-cutting exercise. In any case, with the spate of scams and scandals erupting over the last 12 months, it is perceived that it will do the image of the government a lot of good if it at least announces cost-saving measures by the ministers and the bureaucracy.

An extension of the sunset clause on tax exemptions for Software Technology Parks may not happen. Excise duties on cigarettes may be hiked further, even after they have been hiked in the last two years. A few months ago it looked liked another hike was unlikely. However, such complacency is no longer there-a 7%-10% hike looks likely (it was hiked 15%-17% in the last Budget).

Excise duty may be hiked for cars. On the other hand, excise duty may be cut on food products.

In the last Budget, the government increased excise duty by 2% for passenger vehicles, two-wheelers and commercial vehicles and increased the weighted deduction for research & development from 150% to 200%. It had also reduced income tax rates, which helped drive auto sales indirectly.

Since a lot of hue and cry has been made about inflation being supply-side and mainly due to shortage (of vegetables, pulses & grains), agriculture is likely to be in sharp focus in this Budget. There has been talk that India needs a "second Green Revolution" and it is likely that the government will make allocations in that direction.

Economists have also pointed out that most of the government expenditure in the last 4-5 years has been consumption driven-subsidies, welfare schemes-but has not gone into capacity creation, which has only increased supply-side pressures, another driven of inflation.

It is likely that in this Budget, the government will finally take this criticism seriously and go big in the direction of capacity creation. In this direction, it is possible that project awarding (especially roads) will gather pace.

Within taxes, it is very likely that the government will introduce an amnesty scheme for people to come and declare their black money-this will provide an immediate shot in the arm for revenues.

For the banking & financial sector, the government could provide more tax breaks on longer tenure deposits to increase mobilisation. Banks could be allowed to raise money through infrastructure bonds-while this will be good for banks, it will be negative for Infrastructure Finance Companies.

It is possible that import duties on crude could be brought to zero from the current 5%. Capital goods manufacturers are lobbying strongly for import duties on power equipment for mega-projects. However, since this also escalates the costs of projects, it may not be implemented.

In telecom, it is possible that an import duty may be imposed on handsets to encourage local manufacturing. Service providers that provide bundled imported handsets (especially BlackBerry) could be affected. Some amount of liberalisation in Foreign Direct Investment (FDI) norms for retail could happen-especially pertaining to cold storage. FDI norms may also be liberalised for radio, direct-to-home, and cable.

In real estate, it is likely that there could be an increase in the income-tax deduction for home loans (to Rs3,00,000 from the current Rs1,50,000). It is also likely that interest subvention of 1% on loans of up to Rs1 million on property of Rs2 million will be extended by another year. There is also a slim chance that tax holidays for developing affordable housing (Section 80IB) could be reinstated.

For infra companies, in the last Budget, the government had increased the Minimum Alternate Tax rate from 15% to 18%. It had affected companies putting up projects under special purpose vehicles-this is unlikely to change in this Budget.

Market players do not expect urea to be brought under the Nutrient-Based Subsidy regime in this Budget. Nothing much is expected on the goods & services tax front either. For the Railway Budget, the market does not expect fares to go up, despite the fund crunch.

| Name * : | |

| Email Id * : | |

| Author Url: | |

| Comment*: | |

| alert me when new comment is posted on this article | |

| Security Code: | Not readable? Change text. |

What's Hot

From this section

- Indian Budget for 2011-12 not likely to be pro-market

- In the Union Budget for FY12, there are likely to be cuts in excise duty exemptions and more services may be made liable to be taxed. The government may also reduce the tax burden on the middle class, even as it expands social schemes like NREGA

- Efforts to develop renewable energy suffer setback due to lack of

- Pune-based NGO Prayas Energy Group says that civil society groups must get more involved in the process to develop clean energy programmes, to ensure transparency and social benefits

- Steel prices are going up on speculation, but poor demand may limit

- The chief economist from the ministry of steel feels that the current price movement is due to mere speculation, and raging inflation in the country may reduce demand, which in turn will arrest further rise

- This could be another difficult year for power companies

- Missing power targets could be the least of power generation companies' worries—managing to sell power and securing coal could be bigger issues

- Crude oil prices to remain around $90 in the near term

- The uncertainty in Egypt and the faltering economic recovery in a few developed countries may ensure that prices may not come down dramatically from the current level

http://www.moneylife.in/article/indian-budget-for-2011-12-not-likely-to-be-pro-market/13950.html

--

Central banks must respond in real time, says SubbaraoBusiness Standard - Feb 12, 2011 When Duvvuri Subbarao took charge as the twenty-second governor of the Reserve Bank of India (RBI) in September, 2008, he had to act swiftly to counter the ... Inflation rate needs to be lowered for growth: RBIBusiness Standard - Feb 11, 2011 Despite drastic slowdown seen in industrial growth numbers in December, the Reserve Bank of India (RBI) is expected to continue raising the policy rates as ... RBI again raps banks on teaser loansBusiness Standard - Feb 11, 2011 The Reserve Bank of India (RBI) has once again expressed its discomfort over teaser loan rates and questioned banks' business model for offering such ... Reserve Bank study decline in FDISify - Feb 11, 2011 Reserve Bank of India (RBI) Governor D. Subbarao has said that RBI will study the factors responsible for the decline in the foreign direct investment (FDI) ... It is up to government to deal with black money issue: RBISify - Feb 10, 2011 PTI Bhopal: Reserve Bank of India (RBI) on Thursday said it had limited powers to deal with the issue of black money as confidentiality clause came in the ... Banks curb short-term lending to companiesBusiness Standard - Feb 10, 2011 Banks have started flooring the brakes on short-term corporate loans, as they want greater clarity on the end-use of such funds. ... Managing inflation a tough balancing act, says SubbraoBusiness Standard - - Feb 10, 2011 The Reserve Bank of India (RBI) on Thursday said that inflation was a perennial tension and it would have to do a tough balancing act to set interest rates ... RBI: prepare for effects of Middle East crisisReuters India - - Feb 10, 2011 An opposition supporter carries a placard amid the crowd in Tahrir Square in Cairo February 9, 2011. BHOPAL (Reuters) - India should be prepared for the ... RBI revises norms for primary dealer investmentsSify - - Feb 10, 2011 Primary dealers in India can invest in bonds with initial maturities of up to one year but such investments should not exceed 10 percent of their total ... Hope govt adopts fiscal consolidation plan: D SubbaraoMoneycontrol.com - Feb 10, 2011 The government should adopt a plan of fiscal consolidation in the coming financial year to April 2012 and beyond, the Reserve Bank of India governor Duvvuri ... | Timeline of articlesNumber of sources covering this story

Images |

India Foreign Direct Investment | Economy Watch

FDI India was initiated in 1992. Streamlining of the procedures and substantial liberalization has been done since 1995. Know about FDI in India, ...

www.economywatch.com/foreign-direct-investment/fdi-india/ - Cached - SimilarFDI in India Statistics

FDI in India Statistics. S. No. Name of the Document, Date. India FDI Fact Sheet - November 2010 ... India FDI Fact Sheet - September 2010, 23-11-2010 ...

dipp.nic.in/fdi_statistics/india_fdi_index.htm - Cached - Similar- [PDF]

MANUAL ON FOREIGN DIRECT INVESTMENT IN INDIA - Policy and Procedures

File Format: PDF/Adobe Acrobat - Quick View

information about the policies and procedures governing FDI in India. This ...

dipp.nic.in/manual/manual_0403.pdf - Similar News for fdi india

Govt to up FDI cap in FM radio to 26%

4 hours agoEarlier, the Telecom Regulatory Authority of India (TRAI) had proposed to up FDI limit in FM radio and TV news channels to 26%.Moneycontrol.com - 2 related articlesForeign Direct Investment

India attracted FDI equity inflows of US$ 1392 million in October 2010. The cumulative amount of FDI equity inflows from April 2000 to October 2010 stood at ...

www.ibef.org/economy/fdi.aspx - Cached - SimilarFDI in India's Tourism Industry | India Briefing News

14 Feb 2011 ... By Ankit Shrivastava, Dezan Shira & Associates Introduction Feb. 14 – The Indian tourism industry is interwoven with the country's monetary.

www.india-briefing.com/news/fdi-indias-tourism-industry-4657.html/- [PDF]

Foreign Direct Investment in India: A Critical Analysis...

File Format: PDF/Adobe Acrobat - Quick View

by K Singh - Cited by 15 - Related articles

The Concept of Foreign Direct Investment is now a part of India's economic ..... change that has become a staple of attracting FDI to India ever since. ...

unpan1.un.org/intradoc/groups/public/.../apcity/unpan024036.pdf - Similar Foreign Direct Investment India - FDI in India, Foreign Direct ...

The article provides information about FDI, policy governing FDI in India and FDI across different sectors.

www.tradechakra.com/direct-foreign-india-investment.html - Cached - Similar- [PDF]

FDI in India's Retail Sector

File Format: PDF/Adobe Acrobat - Quick View

FDI in India's Retail Sector. More Bad than Good? By. Mohan Guruswamy. Kamal Sharma. Jeevan Prakash Mohanty. Thomas J. Korah ...

www.indiafdiwatch.org/fileadmin/India.../10-FDI-Retail-more-bad.pdf - Similar Foreign Direct Investment, FDI in India, Real Estate Investment in ...

Foreign Direct Investment in India is permitted under the automatic route in construction and development of housing townships, commercial office space, ...

www.indianground.com/real_estate_fdi.aspx - Cached - Similar

Economy of India

| Economy of The Republic of India | |

|---|---|

Modern Indian currency notes | |

| Rank | 11th (nominal) / 4th (PPP) |

| Currency | 1 Indian Rupee (INR) ( |

| Fiscal year | Calendar year (1 April – 31 March) |

| Trade organizations | WTO, SAFTA, G-20 and others |

| Statistics | |

| GDP | $1.43 trillion (nominal: 11th; 2010)[1] |

| GDP growth | 8.9% (2010, Q2)[2] |

| GDP per capita | $1,176 (nominal: 137th; 2010)[1] |

| GDP by sector | services (57%), industry (28%), agriculture (15%) (2009–10) |

| Inflation (CPI) | 8.43% (December 2010)[3] |

| Population below poverty line | 37% (2010)[4] |

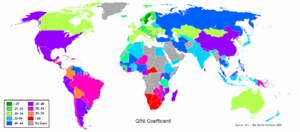

| Gini index | 36.8 (List of countries) |

| Labour force | 478 million (2nd; 2009) |

| Labour force by occupation | agriculture (52%), industry (14%), services (34%) (2009 est.) |

| Unemployment | 9.4% (2009–10)[5] |

| Main industries | telecommunications, textiles, chemicals, food processing, steel, transportation equipment, cement, mining, petroleum, machinery, information technology, pharmaceuticals |

| Ease of Doing Business Rank | 134th[6] |

| External | |

| Exports | $210 billion (17th; 2010) |

| Export goods | software, petroleum products, textile goods, gems and jewellery, engineering goods, chemicals, leather manufactures |

| Main export partners | US 12.3%, UAE 9.4%, China 9.3% (2008) |

| Imports | $327 billion (11th; 2010) |

| Import goods | crude oil, machinery, gems, fertiliser, chemicals |

| Main import partners | China 11.1%, Saudi Arabia 7.5%, US 6.6%, UAE 5.1%, Iran 4.2%, Singapore 4.2%, Germany 4.2% (2008) |

| FDI stock | $191.1 billion (23rd; 2010) |

| Gross external debt | $237.1 billion (2010 est.) |

| Public finances | |

| Public debt | $758 billion (2010)[7] 55.9% of GDP |

| Revenues | $129.8 billion (2009 est.) |

| Expenses | $214.6 billion (2009 est.) |

| Economic aid | $1.724 billion (2005)[8] |

| Credit rating | 1.164 trillion (2010 est.) |

| Foreign reserves | $300 billion (6th; Nov 2010) |

| Main data source: CIA World Fact Book All values, unless otherwise stated, are in US dollars | |

- "Dollar" and "$" refer throughout to the US dollar.

The Economy of India is the eleventh largest in the world by nominal GDP[1] and the fourth largest by purchasing power parity (PPP).[1] The country's per capita GDP (PPP) is $3,290 (IMF, 127th) in 2010.[1] Following strong economic reforms from the socialist inspired economy of a post-independence Indian nation, the country began to develop a fast-paced economic growth, as free market principles were initiated in 1990 for international competition and foreign investment.[9] Economists predict that by 2020, India will be among the leading economies of the world.[10]

India was under social democratic policies from 1947 to 1991. The economy was characterised by extensive regulation, protectionism, public ownership, pervasive corruption and slow growth.[11][12][13] Since 1991, continuing economic liberalisation has moved the country toward a market-based economy.[11][12] A revival of economic reforms and better economic policy in first decade of the 21st century accelerated India's economic growth rate. In recent years, Indian cities have continued to liberalise business regulations.[6] By 2008, India had established itself as the world's second-fastest growing major economy.[14] However, as a result of the financial crisis of 2007–2010, coupled with a poor monsoon, India's gross domestic product (GDP) growth rate significantly slowed to 6.7% in 2008–09, but subsequently recovered to 7.2% in 2009–10, while the fiscal deficit rose from 5.9% to a high 6.5% during the same period.[15] The unemployment rate for 2009–2010, according to the state Labour Bureau, was 9.4 percent nationwide, rising to 10.1 percent in rural areas, where two-thirds of the 1.2 billion population live.[5]

India's large service industry accounts for 57.2% of the country's GDP while the industrial and agricultural sector contribute 28% and 14.6% respectively.[16] Agriculture is the predominant occupation in India, accounting for about 52% of employment. The service sector makes up a further 34%, and industrial sector around 14%.[17] The labour force totals half a billion workers. Major agricultural products include rice, wheat, oilseed, cotton, jute, tea, sugarcane, potatoes, cattle, water buffalo, sheep, goats, poultry and fish.[18] Major industries include telecommunications, textiles, chemicals, food processing, steel, transportation equipment, cement, mining, petroleum, machinery, information technology-enabled services and pharmaceuticals.[18] However, statistics from a 2009-10 government survey, which used a smaller sample size than earlier surveys, suggested that the share of agriculture in employment had dropped to 45.5%.[5]

Previously a closed economy, India's trade and business sector has grown fast.[11] India currently accounts for 1.5% of world trade as of 2007 according to the WTO. According to the World Trade Statistics of the WTO in 2006, India's total merchandise trade (counting exports and imports) was valued at $294 billion in 2006 and India's services trade inclusive of export and import was $143 billion. Thus, India's global economic engagement in 2006 covering both merchandise and services trade was of the order of $437 billion, up by a record 72% from a level of $253 billion in 2004. India's total trade in goods and services has reached a share of 43% of GDP in 2005–06, up from 16% in 1990–91.[19]

Contents[hide] |

[edit] History

[edit] Pre-colonial period (up to 1757)

The citizens of the Indus Valley civilisation, a permanent settlement that flourished between 2800 BC and 1800 BC, practiced agriculture, domesticated animals, used uniform weights and measures, made tools and weapons, and traded with other cities. Evidence of well planned streets, a drainage system and water supply reveals their knowledge of urban planning, which included the world's first urban sanitation systems and the existence of a form of municipal government.[21]

Maritime trade was carried out extensively between South India and southeast and West Asia from early times until around the fourteenth century AD. Both the Malabar and Coromandel Coasts were the sites of important trading centres from as early as the first century BC, used for import and export as well as transit points between the Mediterranean region and southeast Asia.[22] Over time, traders organised themselves into associations which received state patronage. However, state patronage for overseas trade came to an end by the thirteenth century AD, when it was largely taken over by the local Jewish and Muslim communities, initially on the Malabar and subsequently on the Coromandel coast.[23] Further north, the Saurashtra and Bengal coasts played an important role in maritime trade, and the Gangetic plains and the Indus valley housed several centres of river-borne commerce. Most overland trade was carried out via the Khyber Pass connecting the Punjab region with Afghanistan and onward to the Middle East and Central Asia.[24] Although many kingdoms and rulers issued coins, barter was prevalent. Villages paid a portion of their agricultural produce as revenue to the rulers, while their craftsmen received a part of the crops at harvest time for their services.[25]

Religion, especially Hinduism and the caste and the joint family systems, played an influential role in shaping economic activities.[26] The caste system functioned much like medieval European guilds, ensuring the division of labour, providing for the training of apprentices and, in some cases, allowing manufacturers to achieve narrow specialisation. For instance, in certain regions, producing each variety of cloth was the specialty of a particular sub-caste. Textiles such as muslin, Calicos, shawls, and agricultural products such as pepper, cinnamon, opium and indigo were exported to Europe, the Middle East and South East Asia in return for gold and silver.[27]

Assessment of India's pre-colonial economy is mostly qualitative, owing to the lack of quantitative information. The Mughal economy functioned on an elaborate system of coined currency, land revenue and trade. Gold, silver and copper coins were issued by the royal mints which functioned on the basis of free coinage.[28] The political stability and uniform revenue policy resulting from a centralised administration under the Mughals, coupled with a well-developed internal trade network, ensured that India, before the arrival of the British, was to a large extent economically unified, despite having a traditional agrarian economy characterised by a predominance of subsistence agriculture dependent on primitive technology.[29] After the decline of the Mughals, western, central and parts of south and north India were integrated and administered by the Maratha Empire. After the loss at the Third Battle of Panipat, the Maratha Empire disintegrated into several confederate states, and the resulting political instability and armed conflict severely affected economic life in several parts of the country, although this was compensated for to some extent by localised prosperity in the new provincial kingdoms.[30] By the end of the eighteenth century, the British East India Company entered the Indian political theatre and established its dominance over other European powers. This marked a determinative shift in India's trade, and a less powerful impact on the rest of the economy.[31]

[edit] Colonial period (1773–1947)

There is no doubt that our grievances against the British Empire had a sound basis. As the painstaking statistical work of the Cambridge historian Angus Maddison has shown, India's share of world income collapsed from 22.6% in 1700, almost equal to Europe's share of 23.3% at that time, to as low as 3.8% in 1952. Indeed, at the beginning of the 20th Century, "the brightest jewel in the British Crown" was the poorest country in the world in terms of per capita income.

Company rule in India brought a major change in the taxation and agricultural policies, which tended to promote commercialisation of agriculture with a focus on trade, resulting in decreased production of food crops, mass impoverishment and destitution of farmers, and in the short term, led to numerous famines.[33] The economic policies of the British Raj caused a severe decline in the handicrafts and handloom sectors, due to reduced demand and dipping employment.[34] After the removal of international restrictions by the Charter of 1813, Indian trade expanded substantially and over the long term showed an upward trend.[35] The result was a significant transfer of capital from India to England, which, due to the colonial policies of the British, led to a massive drain of revenue instead of any systematic effort at modernisation of the domestic economy.[36]

India's colonisation by the British created an institutional environment that, on paper, guaranteed property rights among the colonisers, encouraged free trade, and created a single currency with fixed exchange rates, standardised weights and measures and capital markets. It also established a well developed system of railways and telegraphs, a civil service that aimed to be free from political interference, a common-law and an adversarial legal system.[38] This coincided with major changes in the world economy – industrialisation, and significant growth in production and trade. However, at the end of colonial rule, India inherited an economy that was one of the poorest in the developing world,[39] with industrial development stalled, agriculture unable to feed a rapidly growing population, a largely illiterate and unskilled labour force, and extremely inadequate infrastructure.[40]

The 1872 census revealed that 91.3% of the population of the region constituting present-day India resided in villages,[41] and urbanisation generally remained sluggish until the 1920s, due to the lack of industrialisation and absence of adequate transportation. Subsequently, the policy of discriminating protection (where certain important industries were given financial protection by the state), coupled with the Second World War, saw the development and dispersal of industries, encouraging rural-urban migration, and in particular the large port cities of Bombay, Calcutta and Madras grew rapidly. Despite this, only one-sixth of India's population lived in cities by 1951.[42]

The impact of the British rule on India's economy is a controversial topic. Leaders of the Indian independence movement and left-nationalist economic historians have blamed colonial rule for the dismal state of India's economy in its aftermath and stated that financial strength required for industrial development in Europe was derived from the wealth taken from colonies in Asia and Africa. At the same time, right-wing historians have countered that India's low economic performance was due to various sectors being in a state of growth and decline due to changes brought in by colonialism and a world that was moving towards industrialisation and economic integration.[43]

[edit] Pre-liberalisation period (1947–1991)

Indian economic policy after independence was influenced by the colonial experience, which was seen by Indian leaders as exploitative, and by those leaders' exposure to democratic socialism as well as the progress achieved by the economy of the Soviet Union.[40] Domestic policy tended towards protectionism, with a strong emphasis on import substitution, industrialisation, economic interventionism, a large public sector, business regulation, and central planning,[44] while trade and foreign investment policies were relatively liberal.[45] Five-Year Plans of India resembled central planning in the Soviet Union. Steel, mining, machine tools, water, telecommunications, insurance, and electrical plants, among other industries, were effectively nationalised in the mid-1950s.[46]

Jawaharlal Nehru, the first prime minister of India, along with the statistician Prasanta Chandra Mahalanobis, formulated and oversaw economic policy during the initial years of the country's existence. They expected favorable outcomes from their strategy, involving the rapid development of heavy industry by both public and private sectors, and based on direct and indirect state intervention, rather than the more extreme Soviet-style central command system.[47][48] The policy of concentrating simultaneously on capital- and technology-intensive heavy industry and subsidizing manual, low-skill cottage industries was criticised by economist Milton Friedman, who thought it would waste capital and labour, and retard the development of small manufacturers.[49] The rate of growth of the Indian economy in the first three decades after independence was derisively referred to as the Hindu rate of growth, because of the unfavourable comparison with growth rates in other Asian countries, especially the East Asian Tigers.[50][51]

Since 1965, the use of high-yielding varieties of seeds, increased fertilisers and improved irrigation facilities collectively contributed to the Green Revolution in India, which improved the condition of agriculture in India by increasing productivity of food as well as commercial crops, improving crop patterns and strengthening forward and backward linkages between agriculture and industry.[52] However, it has also been criticised as an unsustainable effort, resulting in the growth of capitalistic farming, ignoring institutional reforms and widening income disparities.[53]

[edit] Post-liberalisation period (since 1991)

In the late 1970s, the government led by Morarji Desai eased restrictions on capacity expansion for incumbent companies, removed price controls, reduced corporate taxes and promoted the creation of small scale industries in large numbers. However, the subsequent government policy of Fabian socialism hampered the benefits of the economy, leading to high fiscal deficits and a worsening current account. The collapse of the Soviet Union, which was India's major trading partner, and the first Gulf War, which caused a spike in oil prices, caused a major balance-of-payments crisis for India, which found itself facing the prospect of defaulting on its loans.[54] India asked for a $1.8 billion bailout loan from the International Monetary Fund (IMF), which in return demanded reforms.[55]

In response, Prime Minister Narasimha Rao, along with his finance minister Manmohan Singh, initiated the economic liberalisation of 1991. The reforms did away with the Licence Raj (investment, industrial and import licensing), reduced tariffs and interest rates and ended many public monopolies, allowing automatic approval of foreign direct investment in many sectors.[56] Since then, the overall direction of liberalisation has remained the same, irrespective of the ruling party, although no party has tried to take on powerful lobbies such as the trade unions and farmers, or contentious issues such as reforming labour laws and reducing agricultural subsidies.[57] By the turn of the 20th century, India had progressed towards a free-market economy, with a substantial reduction in state control of the economy and increased financial liberalisation.[58] This has been accompanied by increases in life expectancy, literacy rates and food security, although the beneficiaries have largely been urban residents.[59]

While the credit rating of India was hit by its nuclear tests in 1998, it has since been raised to investment level in 2003 by S&P and Moody's.[60] In 2003, Goldman Sachs predicted that India's GDP in current prices would overtake France and Italy by 2020, Germany, UK and Russia by 2025 and Japan by 2035. By 2035, it was projected to be the third largest economy of the world, behind the US and China. India is often seen by most economists as a rising economic superpower and is believed to play a major role in the global economy in the 21st century.[61][62]

[edit] Sectors

[edit] Industry and services

Industry accounts for 28% of the GDP and employ 14% of the total workforce.[17] In absolute terms, India is 12th in the world in terms of nominal factory output.[65] The Indian industrial sector underwent significantly changes as a result of the economic reforms of 1991, which removed import restrictions, brought in foreign competition, led to privatisation of certain public sector industries, liberalised the FDI regime, improved infrastructure and led to an expansion in the production of fast moving consumer goods.[66] Post-liberalisation, the Indian private sector was faced with increasing domestic as well as foreign competition, including the threat of cheaper Chinese imports. It has since handled the change by squeezing costs, revamping management, and relying on cheap labour and new technology. However, this has also reduced employment generation even by smaller manufacturers who earlier relied on relatively labour-intensive processes.[67]

Textile manufacturing is the second largest source of employment after agriculture and accounts for 20% of manufacturing output, providing employment to over 20 million people.[68] Ludhiana produces 90% of woollens in India and is known as the Manchester of India. Tirupur has gained universal recognition as the leading source of hosiery, knitted garments, casual wear and sportswear.[69]

India is 13th in services output. The services sector provides employment to 23% of the work force and is growing quickly, with a growth rate of 7.5% in 1991–2000, up from 4.5% in 1951–80. It has the largest share in the GDP, accounting for 55% in 2007, up from 15% in 1950.[17] Information technology and business process outsourcing are among the fastest growing sectors, having a cumulative growth rate of revenue 33.6% between 1997–98 and 2002–03 and contributing to 25% of the country's total exports in 2007–08.[70] The growth in the IT sector is attributed to increased specialisation, and an availability of a large pool of low cost, but highly skilled, educated and fluent English-speaking workers, on the supply side. This is matched on the demand side by an increased demand from foreign consumers interested in India's service exports, or those looking to outsource their operations. The share of the Indian IT industry in the country's GDP increased from 4.8 % in 2005–06 to 7% in 2008.[71] In 2009, seven Indian firms were listed among the top 15 technology outsourcing companies in the world.[72] Tourism in India is relatively undeveloped, but growing at double digits. Some hospitals woo medical tourism.[73]

Organised retail supermarkets accounts for 24% of the market as of 2008.[74] Regulations prevent most foreign investment in retailing. Moreover, over thirty regulations such as "signboard licences" and "anti-hoarding measures" may have to be complied before a store can open doors. There are taxes for moving goods from state to state, and even within states.[74]

Mining forms an important segment of the Indian economy, with the country producing 79 different minerals (excluding fuel and atomic resources) in 2009–10, including iron ore, manganese, mica, bauxite, chromite, limestone, asbestos, fluorite, gypsum, ochre, phosphorite and silica sand.[75]

[edit] Agriculture

India ranks second worldwide in farm output. Agriculture and allied sectors like forestry, logging and fishing accounted for 15.7% of the GDP in 2009–10, employed 52.1% of the total workforce, and despite a steady decline of its share in the GDP, is still the largest economic sector and a significant piece of the overall socio-economic development of India.[78] Yields per unit area of all crops have grown since 1950, due to the special emphasis placed on agriculture in the five-year plans and steady improvements in irrigation, technology, application of modern agricultural practices and provision of agricultural credit and subsidies since the Green Revolution in India. However, international comparisons reveal the average yield in India is generally 30% to 50% of the highest average yield in the world.[79]

India receives an average annual rainfall of 1,208 millimetres (47.6 in) and a total annual precipitation of 4000 billion cubic metres, with the total utilisable water resources, including surface and groundwater, amounting to 1123 billion cubic metres.[80] 546,820 square kilometres (211,130 sq mi) of the land area, or about 39% of the total cultivated area, is irrigated.[81] India's inland water resources including rivers, canals, ponds and lakes and marine resources comprising the east and west coasts of the Indian ocean and other gulfs and bays provide employment to nearly six million people in the fisheries sector. In 2008, India had the world's third largest fishing industry.[82]

India is the largest producer in the world of milk, jute and pulses, and also has the world's second largest cattle population with 175 million animals in 2008.[76] It is the second largest producer of rice, wheat, sugarcane, cotton and groundnuts, as well as the second largest fruit and vegetable producer, accounting for 10.9% and 8.6% of the world fruit and vegetable production respectively.[76] India is also the second largest producer and the largest consumer of silk in the world, producing 77,000 million tons in 2005.[83]

[edit] Banking and finance

The Indian money market is classified into the organised sector, comprising private, public and foreign owned commercial banks and cooperative banks, together known as scheduled banks, and the unorganised sector, which includes individual or family owned indigenous bankers or money lenders and non-banking financial companies.[84] The unorganised sector and microcredit are still preferred over traditional banks in rural and sub-urban areas, especially for non-productive purposes, like ceremonies and short duration loans.[85]

Prime Minister Indira Gandhi nationalised 14 banks in 1969, followed by six others in 1980, and made it mandatory for banks to provide 40% of their net credit to priority sectors like agriculture, small-scale industry, retail trade, small businesses, etc. to ensure that the banks fulfill their social and developmental goals. Since then, the number of bank branches has increased from 8,260 in 1969 to 72,170 in 2007 and the population covered by a branch decreased from 63,800 to 15,000 during the same period. The total bank deposits increased from ![]() 5,910 crore (US$1.28 billion) in 1970–71 to

5,910 crore (US$1.28 billion) in 1970–71 to ![]() 3,830,922 crore (US$831.31 billion) in 2008–09. Despite an increase of rural branches, from 1,860 or 22% of the total number of branches in 1969 to 30,590 or 42% in 2007, only 32,270 out of 500,000 villages are covered by a scheduled bank.[86][87]

3,830,922 crore (US$831.31 billion) in 2008–09. Despite an increase of rural branches, from 1,860 or 22% of the total number of branches in 1969 to 30,590 or 42% in 2007, only 32,270 out of 500,000 villages are covered by a scheduled bank.[86][87]

India's gross domestic saving in 2006–07 as a percentage of GDP stood at a high 32.7%.[88] More than half of personal savings are invested in physical assets such as land, houses, cattle, and gold.[89] The public sector banks hold over 75% of total assets of the banking industry, with the private and foreign banks holding 18.2% and 6.5% respectively.[90] Since liberalisation, the government has approved significant banking reforms. While some of these relate to nationalised banks, like encouraging mergers, reducing government interference and increasing profitability and competitiveness, other reforms have opened up the banking and insurance sectors to private and foreign players.[17][91]

[edit] Energy and power

India's oil reserves meet 25% of the country's domestic oil demand.[17][93] As of 2009, India's total proven oil reserves stood at 775 million metric tonnes while gas reserves stood at 1074 billion cubic metres.[94] Oil and natural gas fields are located offshore at Mumbai High, Krishna Godavari Basin and the Cauvery Delta, and onshore mainly in the states of Assam, Gujarat and Rajasthan.[94] India is the fourth largest consumer of oil in the world and imported $82.1 billion worth of oil in the first three quarters of 2010, which had an adverse effect on its current account deficit.[92] The petroleum industry in India mostly consists of public sector companies such as Oil and Natural Gas Corporation (ONGC), Hindustan Petroleum Corporation Limited (HPCL) and Indian Oil Corporation Limited (IOCL). There are some major private Indian companies in the oil sector such as Reliance Industries Limited (RIL) which operates the world's largest oil refining complex.[95]

As of 2010, India had an installed power generation capacity of 164,835 megawatts (MW), of which thermal power contributed 64.6%, hydroelectricity 24.7%, other sources of renewable energy 7.7%, and nuclear power 2.9%.[96] India meets most of its domestic energy demand through its 106 billion tonnes of coal reserves.[97] India is also rich in certain renewable sources of energy with significant future potential such as solar, wind and biofuels (jatropha, sugarcane). India's huge thorium reserves – about 25% of world's reserves – are expected to fuel the country's ambitious nuclear energy program in the long-run. India's dwindling uranium reserves stagnated the growth of nuclear energy in the country for many years.[98] However, the Indo-US nuclear deal has paved the way for India to import uranium from other countries.[99]

[edit] External trade and investment

[edit] Global trade relations

Until the liberalisation of 1991, India was largely and intentionally isolated from the world markets, to protect its economy and to achieve self-reliance. Foreign trade was subject to import tariffs, export taxes and quantitative restrictions, while foreign direct investment (FDI) was restricted by upper-limit equity participation, restrictions on technology transfer, export obligations and government approvals; these approvals were needed for nearly 60% of new FDI in the industrial sector. The restrictions ensured that FDI averaged only around $200 million annually between 1985 and 1991; a large percentage of the capital flows consisted of foreign aid, commercial borrowing and deposits of non-resident Indians.[100] India's exports were stagnant for the first 15 years after independence, due to general neglect of trade policy by the government of that period. Imports in the same period, due to industrialisation being nascent, consisted predominantly of machinery, raw materials and consumer goods.[101]

Since liberalisation, the value of India's international trade has increased sharply,[102] with the contribution of total trade in goods and services to the GDP rising from 16% in 1990–91 to 43% in 2005–06.[19] India's major trading partners are the European Union, China, the United States and the United Arab Emirates.[103] In 2006–07, major export commodities included engineering goods, petroleum products, chemicals and pharmaceuticals, gems and jewellery, textiles and garments, agricultural products, iron ore and other minerals. Major import commodities included crude oil and related products, machinery, electronic goods, gold and silver.[104] In November 2010, exports increased 22.3% year-on-year to ![]() 85,063 crore (US$18.46 billion), while imports were up 7.5% at

85,063 crore (US$18.46 billion), while imports were up 7.5% at ![]() 125,133 crore (US$27.15 billion). Trade deficit for the same month dropped from

125,133 crore (US$27.15 billion). Trade deficit for the same month dropped from ![]() 46,865 crore (US$10.17 billion) in 2009 to

46,865 crore (US$10.17 billion) in 2009 to ![]() 40,070 crore (US$8.7 billion) in 2010.[105]

40,070 crore (US$8.7 billion) in 2010.[105]

India is a founding-member of General Agreement on Tariffs and Trade (GATT) since 1947 and its successor, the WTO. While participating actively in its general council meetings, India has been crucial in voicing the concerns of the developing world. For instance, India has continued its opposition to the inclusion of such matters as labour and environment issues and other non-tariff barriers to trade into the WTO policies.[106]

[edit] Balance of payments

Since independence, India's balance of payments on its current account has been negative. Since economic liberalisation in the 1990s, precipitated by a balance of payment crisis, India's exports rose consistently, covering 80.3% of its imports in 2002–03, up from 66.2% in 1990–91.[107] However, the global economic slump followed by a general deceleration in world trade saw the exports as a percentage of imports drop to 61.4% in 2008–09.[108] India's growing oil import bill is seen as the main driver behind the large current account deficit,[92] which rose to $118.7 billion, or 9.7% of GDP, in 2008–09.[109] Between January and October 2010, India imported $82.1 billion worth of crude oil.[92]

Due to the global late-2000s recession, both Indian exports and imports declined by 29.2% and 39.2% respectively in June 2009.[110] The steep decline was because countries hit hardest by the global recession, such as United States and members of the European Union, account for more than 60% of Indian exports.[111] However, since the decline in imports was much sharper compared to the decline in exports, India's trade deficit reduced to ![]() 25,250 crore (US$5.48 billion).[110]

25,250 crore (US$5.48 billion).[110]

India's reliance on external assistance and concessional debt has decreased since liberalisation of the economy, and the debt service ratio decreased to from 35.3% in 1990–91 to 4.4% in 2008–09.[112] In India, External Commercial Borrowings (ECBs), or commercial loans from non-resident lenders, are being permitted by the Government for providing an additional source of funds to Indian corporates. The Ministry of Finance monitors and regulates them through ECB policy guidelines issued by the Reserve Bank of India under the Foreign Exchange Management Act of 1999.[113] India's foreign exchange reserves have steadily risen from $5.8 billion in March 1991 to $283.5 billion in December 2009. [114]

[edit] Foreign direct investment in India

| Share of top five investing countries in FDI inflows. (2000–2010)[115] | |||

| Rank | Country | Inflows (million USD) | Inflows (%) |

|---|---|---|---|

| 1 | Mauritius | 50,164 | 42.00 |

| 2 | Singapore | 11,275 | 9.00 |

| 3 | USA | 8,914 | 7.00 |

| 4 | UK | 6,158 | 5.00 |

| 5 | Netherlands | 4,968 | 4.00 |

As the fourth-largest economy in the world in PPP terms, India is a preferred destination for FDI;[116] India has strengths in telecommunication, information technology and other significant areas such as auto components, chemicals, apparels, pharmaceuticals, and jewellery. Despite a surge in foreign investments, rigid FDI policies resulted in a significant hindrance. However, due to some positive economic reforms aimed at deregulating the economy and stimulating foreign investment, India has positioned itself as one of the front-runners of the rapidly growing Asia Pacific Region.[116] India has a large pool of skilled managerial and technical expertise. The size of the middle-class population stands at 300 million and represents a growing consumer market.[117]

During 2000–10, the country attracted $178 billion as FDI.[118] The inordinately high investment from Mauritius is due to routing of international funds through the country given significant tax advantages; double taxation is avoided due to a tax treaty between India and Mauritius, and Mauritius is a capital gains tax haven, effectively creating a zero-taxation FDI channel.[119]

India's recently liberalised FDI policy (2005) allows up to a 100% FDI stake in ventures. Industrial policy reforms have substantially reduced industrial licensing requirements, removed restrictions on expansion and facilitated easy access to foreign technology and foreign direct investment FDI. The upward moving growth curve of the real-estate sector owes some credit to a booming economy and liberalised FDI regime. In March 2005, the government amended the rules to allow 100% FDI in the construction sector, including built-up infrastructure and construction development projects comprising housing, commercial premises, hospitals, educational institutions, recreational facilities, and city- and regional-level infrastructure.[120]

A number of changes were approved on the FDI policy to remove the caps in most sectors. Fields which require relaxation in FDI restrictions include civil aviation, construction development, industrial parks, petroleum and natural gas, commodity exchanges, credit-information services and mining. But this still leaves an unfinished agenda of permitting greater foreign investment in politically sensitive areas such as insurance and retailing. The total FDI equity inflow into India in 2008–09 stood at![]() 122,919 crore (US$26.67 billion), a growth of 25% in rupee terms over the previous period.[121]. Consequently, India's FDI Policy has been changed to avail the existing oppertunities.